Economic Response to the Coronavirus

As a result of the Coronavirus outbreak, the Australian Government has recently announced an economic response totalling $17.6 billion. The aim is to protect the economy by maintaining business confidence, helping small businesses to manage cash flow challenges and provide targeted support. This will ensure that the economy is in a favourable position to recover as shock subsides.

Government support targets the following key areas for Australian businesses:

- Cash flow assistance for businesses

- Support for business investments

Cash Flow Assistance for Businesses

Assistance will be provided to help businesses manage their cash flow and retain employees. Two measures (explained below) will support small and medium enterprises and improve business confidence.

1. Boosting Cash Flow for Employers

This measure will provide up to $25,000 to businesses, with a minimum payment of $2,000 for eligible businesses. These payments will be tax free.

Eligibility

Small and medium business entities with employees and aggregated annual turnover of under $50 million will be eligible (based on prior year turnover).

The payment will be delivered by the Australian Taxation Office (ATO) as a credit in the Activity Statement system from 28 April 2020, upon businesses lodging eligible upcoming activity statements.

Eligible businesses that withhold tax to the ATO on their employees’ salary and wages will receive a payment equal to 50 per cent of the amount withheld, up to a maximum payment of $25,000.

Eligible businesses that pay salary and wages will receive a minimum payment of $2,000, even if they are not required to withhold tax.

Assistance Dates

The ATO will deliver the payment as a credit to the business upon lodgement of their activity statements. If this places the business in a refund position, the ATO will deliver the refund within 14 days.

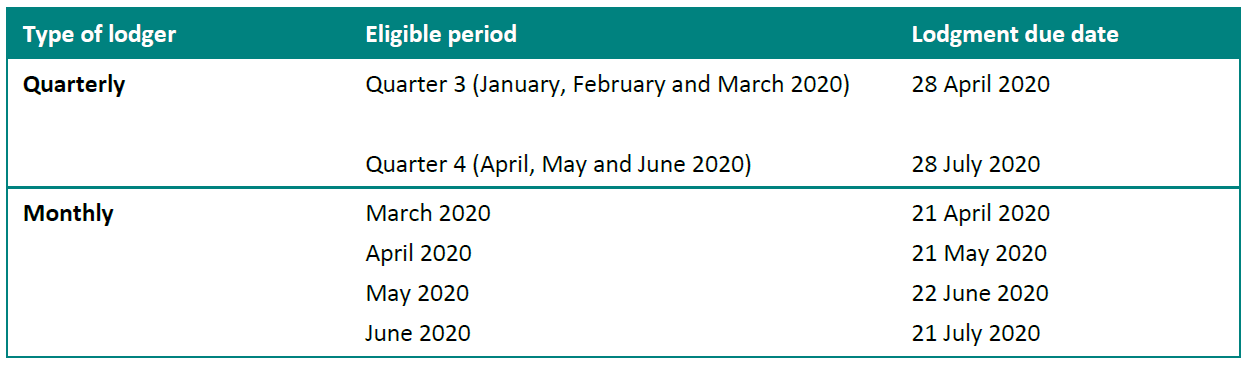

Quarterly lodgers will be eligible to receive the payment for the quarters ending March 2020 and June 2020. Monthly lodgers will be eligible to receive the payment for the March 2020, April 2020, May 2020 and June 2020 lodgements. The minimum payment will be applied to the business’ first lodgement (please see table below):

Source: The Australian Government Treasury

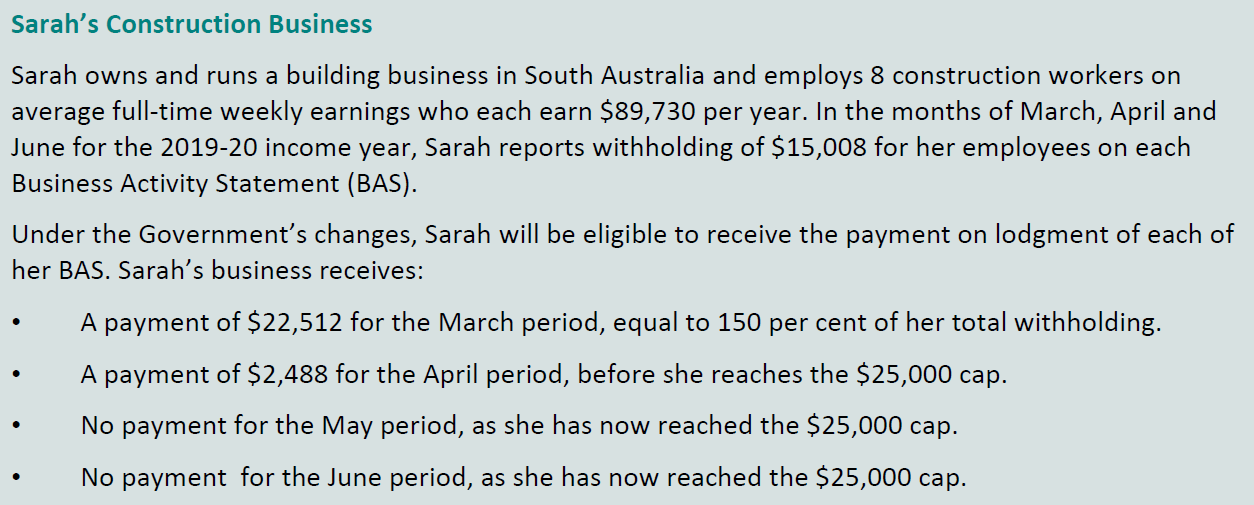

An example scenario has been provided below:

Source: The Australian Government Treasury

2. Supporting Apprentices and Trainees

The government will also be supporting small businesses to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50% of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer.

Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter).

Eligibility

The subsidy is available to small businesses who retain an apprentice or trainee and employ fewer than 20 full-time employees. The apprentice or trainee must have been in training with a small business as at 1 March 2020.

Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network (AASN) provider.

Assistance Dates

Employers can register for this subsidy from early-April 2020. Final claims for payment must be lodged by 31 December 2020.

Further information is available at:

- The Department of Education, Skills and Employment website at: www.dese.gov.au

- Australian Apprenticeships website at: www.australianapprenticeships.gov.au

For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Support for Business Investments

The Government is also backing businesses to invest with the intention of helping the economy recover from Coronavirus impact. As part of this package, there are two business investment measures.

1. Increasing the Instant Asset Write-Off

The Government has increased the instant asset write-off threshold from $30,000 to $150,000 and expanded access to include businesses with aggregated annual turnover of less than $500 million (up from $50 million) until 30 June 2020.

2. Backing Business Investment

The Government is introducing a limited time 15-month investment incentive (through to 30 June 2021) to support investment in the short term, by accelerating depreciation deductions. Businesses with a turnover of less than $500 million will be able to deduct 50 per cent of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost.

Summary

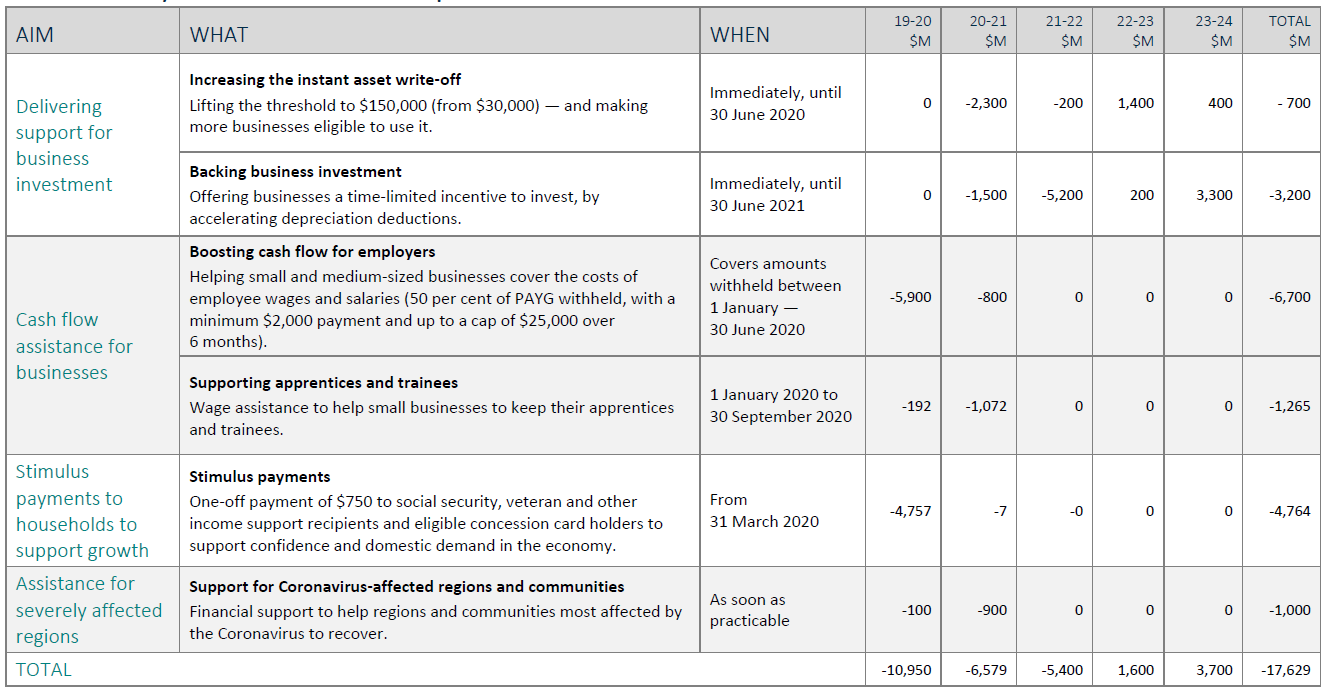

A summary and timeline of the government’s economic response to the Coronavirus has been included in the table below:

Source: The Australian Government Treasury

A number of resources on the government’s economic response are available at treasury.gov.au/coronavirus. This includes summaries and factsheets for Australian businesses. Businesses can also visit business.gov.au to find out more about how the response complements the range of support available to small and medium businesses.

The ATO offers a range of support services to small and medium businesses experiencing hardship — visit ato.gov.au to find out more.

Alternatively, to chat to a bookkeeper about how these changes will affect you and your business, please don’t hesitate to get in touch with us.

Our Bookkeepers

Justine Day: Southern Highlands / Bowral Bookkeeper

Amanda Graham: Southern Highlands / Bowral Bookkeeper

Petra Austing: Southern Highlands / Bowral Bookkeeper

Karin Evans: Gold Coast Bookkeeper

Pru Hall: Wollongong Bookkeeper

Jackie Short: Canberra Bookkeeper